ShipEngine, in conjunction with Retail Economics, has built your guide forthe holiday shopping trends that will define the 2023 holiday shopping season. We gathered insight from over 8,000 shoppers and merchants in major markets across the globe. This guide helps you understand the preferences of ecommerce shoppers. While many geos like Europe and Australia are seeing less money spent, North American consumers remain much more optimistic and plan to spend roughly $182.9B this holiday season. Businesses have an opportunity to capitalize on ecommerce sales this year if they can provide an experience shoppers expect. In fact, 60% of shoppers anticipate doing a majority of their shopping online. Creating effective selling and fulfillment strategies are necessary for retailers to stay ahead of the competition.

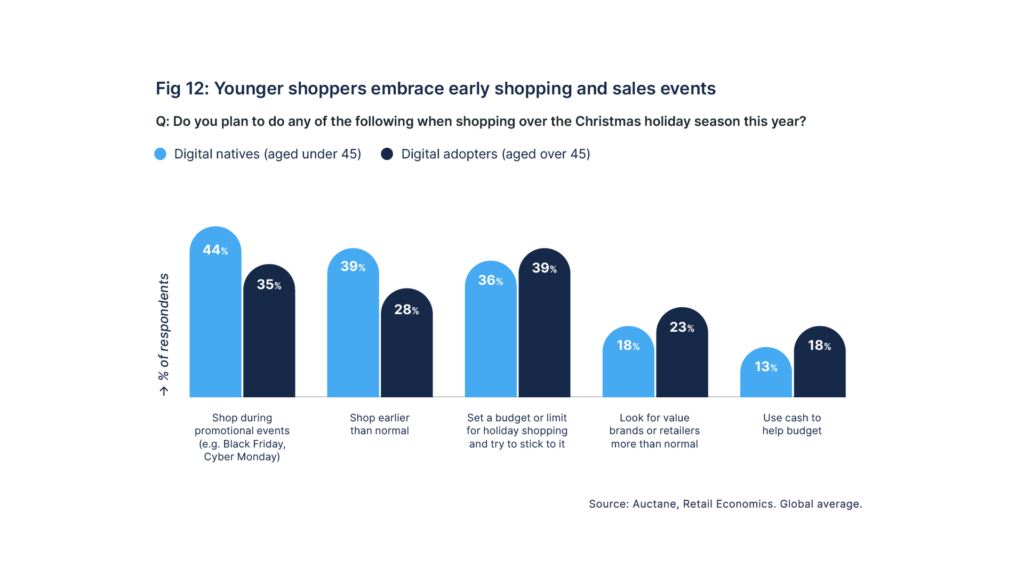

Consumer spending continues to evolve and reshape. The major trends we uncovered are that customers shop over a much longer holiday shopping season, express delivery options matter, and marketplaces are more popular than years past. This runs against the grain of trends from previous years when supply chain issues and closing businesses inspired customers to shop from smaller, independent businesses and accept longer fulfillment and delivery times. However, as manufacturing stabilizes and inflation rates remain high, customers are more cost-conscious and prefer to hunt for bargains. It’s not just younger generations, either—older digital adopters are learning to embrace online shopping. Customers also expect express delivery options at affordable prices over the long-preferred standard, free options. Our Holiday Shopping Trends Report dives into what is influencing these new trends, where you have opportunities for success, and how other businesses plan on catering to their customers. With a few tweaks to your service offerings, you can be ahead of the competition all season long.

Download the Full eBook

Shoppers Are Ready For Bargain Hunting

The official kickoff to the holiday shopping season may be Black Friday, but businesses and consumers start well before then. For instance, Amazon kicks off their holiday shopping season with Amazon Prime Day Early Access, offering promotions starting in October. Furthermore, customers aren’t only shopping sooner, they shop for longer. Many marketplaces and retailers offer holiday sales through much of December. Shopping around has made customers more cost-conscious and more concerned with delivery costs and transit times. Because the new norm is a longer holiday shopping season, merchants not selling where customers are shopping may find themselves out in the cold come winter.

Be Ready for Marketplace Shoppers

Buying from established marketplaces provides a greater sense of security for shoppers. Their conveniences attracts 68% of global shoppers to places like Amazon and Walmart over other forms of online sales channels. Two-day delivery and flexible returns are the buyer-leaning advantages. Additional membership perks like Amazon Prime provide even more cost savings, quicker deliveries, and features that keep shoppers coming back.

Merchants, however, have less of a favorable time selling products on these marketplaces. Their rigid delivery guidelines, tighter profit margins, and customer-leaning refund policies can cut into your bottom line more than hosting products on your own website. However, there are still advantages.

Due to their popularity among consumers, listing products on Amazon, eBay, or Walmart can do more for brand awareness and buying potential than costly marketing campaigns. It makes sense, then, that the majority of merchants (53%) selling on marketplaces do so because they can reach a broader audience. Despite the innumerable online stores, there are only a handful of marketplaces that most people shop from. And half of all online holiday orders will be through a marketplace in 2023.

Delivery Options Matter

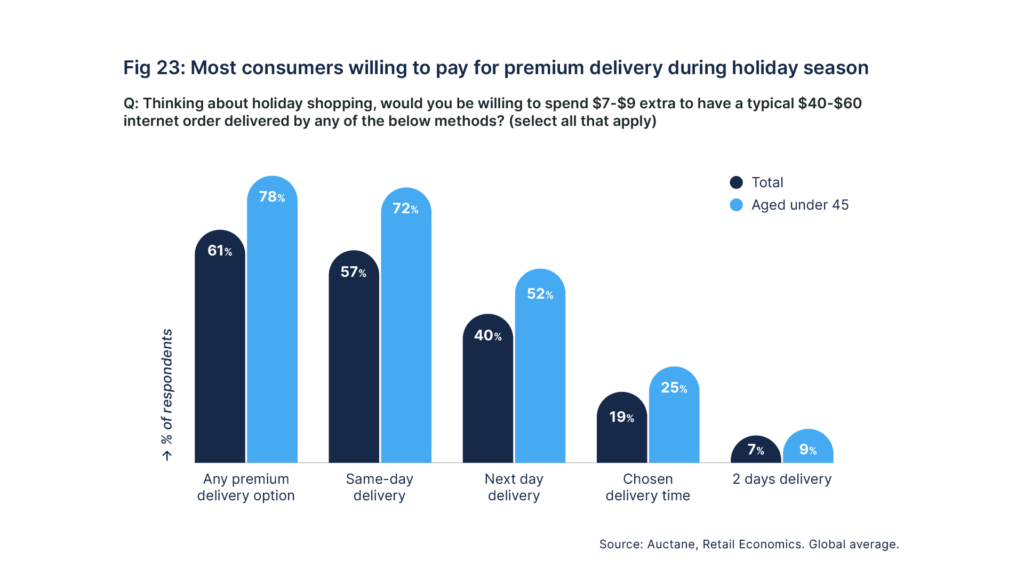

Free delivery drives a lot of online sales—but it’s by no means the only winning tactic. Premium shipping options provide buyers with peace of mind and quicker delivery times.

This comes in handy during the holiday season when shoppers have heightened concerns about timely, secure delivery.

This is especially true the closer we get to holiday shipping deadlines. With porch pirates and delivery delays on the rise during the holiday season, Americans’ major holiday shipping concern is lost or stolen packages. Shoppers in many of the other geos are more worried about on-time delivery and delivery costs during the holiday season. Delivery security is less of a concern in countries where PUDO (pick up, drop off) delivery options are common. Retailers have options to provide shoppers with delivery security, though. And premium features like signature confirmation, weekend delivery, and express delivery soothe concerns, particularly for last-minute shoppers. We found that a majority of consumers (61%) are willing to pay up to $9 for services such as same-day, next-day, or premium delivery during the holiday season. This increases to as high as 78% among individuals under 45 (Millennials and Gen Z) – the most commercially significant consumer demographic for online retail. Because this price may not cover the full cost of shipping—particularly for premium delivery options, affordable shipping is key.

Get Your Copy Now

Our 2023 Holiday Shopping Trends report dives into much more than these three topics. To get a country-by-country breakdown, more delivery preferences and insight from other merchants, you can get your own copy!

Leave a Reply